Free 1099 Tax Forms Printable Updated November 06 2023 IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more There are 20 active types of 1099 forms used for various income types 1099s fall into a group of tax documents called information returns because they notify

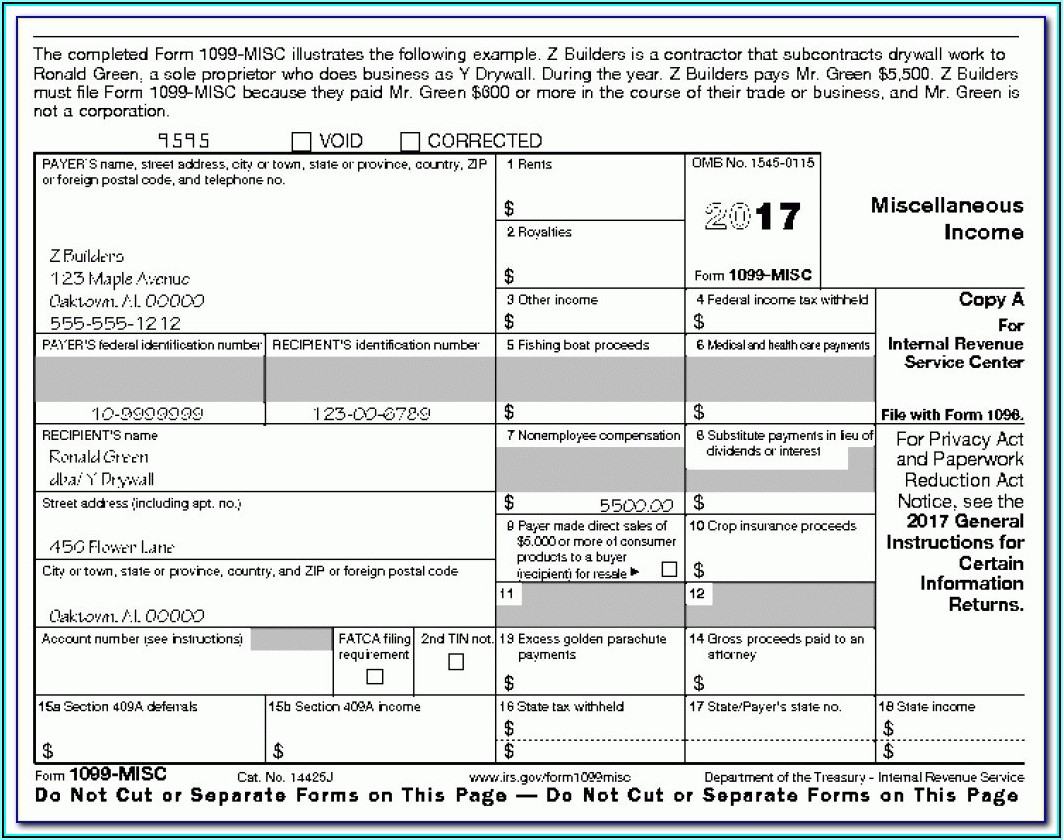

IRS Form 1099 MISC Updated November 27 2023 A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form With IRIS businesses can e file both small and large volumes of 1099 series forms by either keying in the information or uploading a file with the use of a downloadable template Currently IRIS accepts Forms 1099 only for tax year 2022 and later

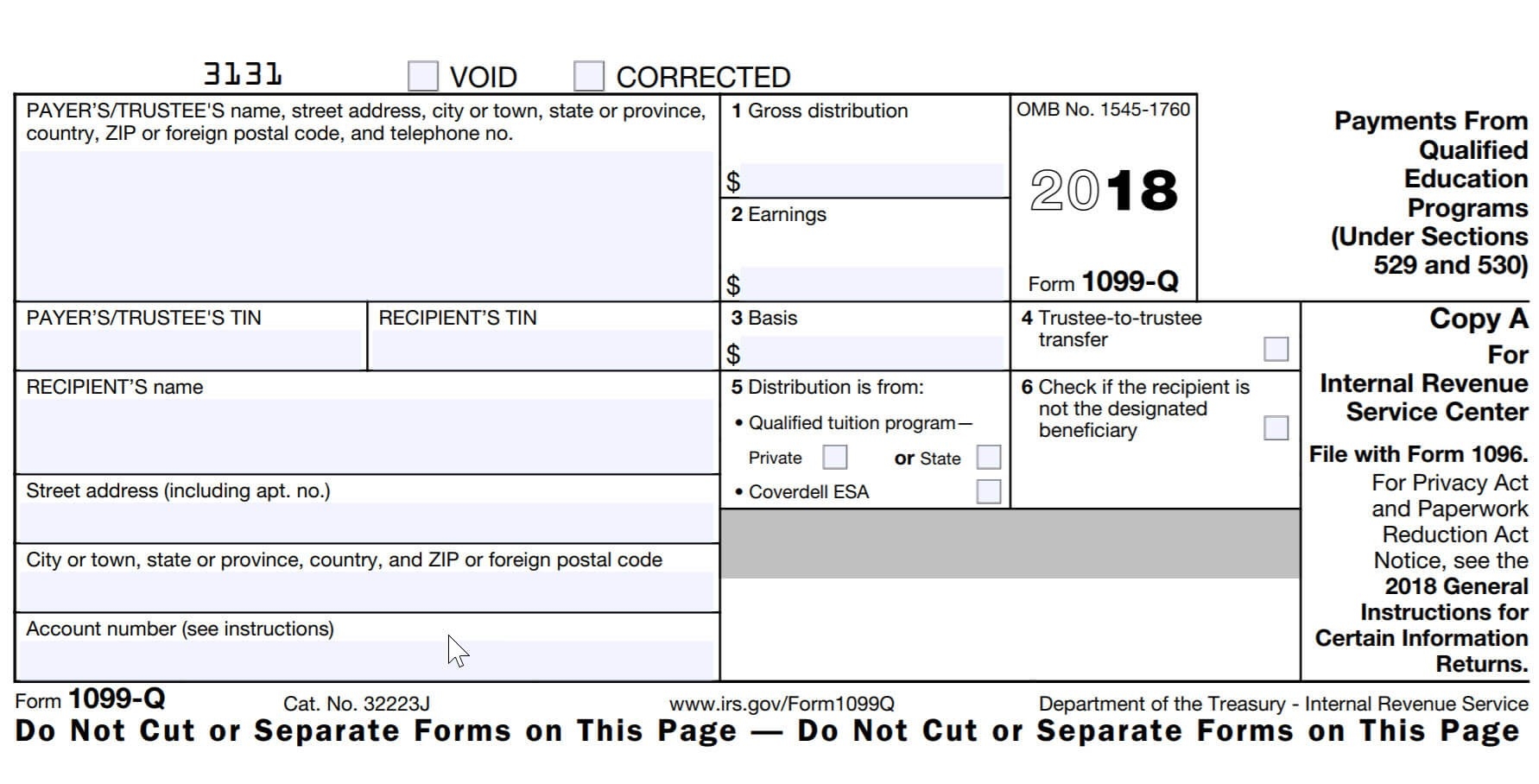

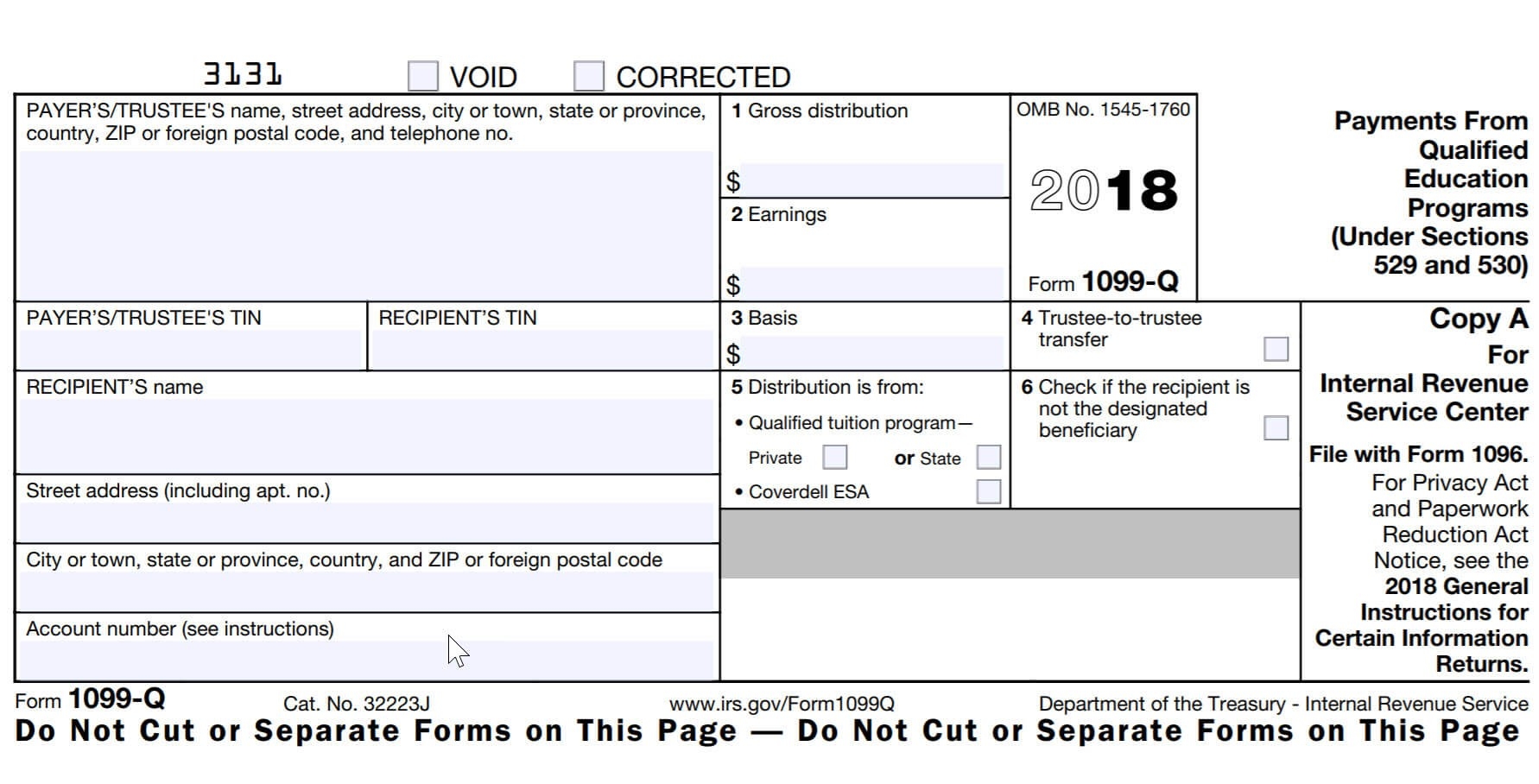

Free 1099 Tax Forms Printable

Free 1099 Tax Forms Printable

Fillable Form Onliine 1099 Correction Printable Forms Free Online

Free Printable 1099 Tax Form

Filing due dates for 1099 MISC forms have also been updated for the 2023 tax year The 1099 MISC must be sent To recipients by January 31 2024 To the IRS by February 28 2024 if filing by mail To the IRS by April 1 2024 if e filing The deadline for the 1099 MISC is different from the deadline for the 1099 NEC From there Click Print 1099 NEC or Print 1099 MISC Select which date range you re looking for then click OK Select each contractor you want to print 1099s for Click Print 1099 or Print 1096 if you only want that form Make sure you ve got the right paper in your printer

As noted earlier in prior years contractor payments were included in Form 1099 MISC If you need to file a 1099 for nonemployee income paid in 2019 you would use the 2019 1099 MISC We cover 1099 MISC and other types of 1099 forms in more detail later in this article The due date for furnishing a copy to your contractors and vendors and filing a copy with the IRS is Jan 31 for most A powerful tax and accounting research tool Get more accurate and efficient results with the power of AI cognitive computing and machine learning Printable 1099 forms Prepare form 1099 all variations Printable 1099 forms You can print the following number of copies for these 1099 forms on 1 page 1098 2 copies 1098 C 1 copy 1098

More picture related to Free 1099 Tax Forms Printable

Free Printable 1099 Misc Forms Free Printable

Download Fillable 1099 Form Printable Forms Free Online

Form 1099 Misc Downloadable And Printable Printable Forms Free Online

The IRS has released a new tax filing form for people 65 and older It is an easier to read version of the 1040 form It has bigger print less shading and features like a standard deduction chart The form is optional and uses the same schedules instructions and attachments as the regular 1040 Accessible federal tax forms Updated November 27 2023 A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees during a calendar year The paying party must issue a 1099 NEC if payments during the year exceed 600 and the recipient must use the form to report their income when filing taxes

The IRS 1099 Form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn t your employer The payer fills out the form with the appropriate details and sends copies to you and the IRS reporting payments made during the tax year In some instances a copy is also sent to 1099 MISC forms for all purposes are due to the IRS by February 28 2024 or March 31 2024 if you re filing electronically You must issue the form to the recipient by February 15 2024 for gross proceeds paid to attorneys substitute dividends or tax exempt interest payments You should issue all other payments to the recipient by

Free Printable 1099 Tax Form

Printable Form It 1099 R Printable Forms Free Online

https://eforms.com/irs/form-1099/

Updated November 06 2023 IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more There are 20 active types of 1099 forms used for various income types 1099s fall into a group of tax documents called information returns because they notify

https://eforms.com/irs/form-1099/misc/

IRS Form 1099 MISC Updated November 27 2023 A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form

TSP 2020 Form 1099 R Statements Should Be Examined Carefully

Free Printable 1099 Tax Form

Free Form 1099 MISC PDF Word

1099 Contract Template HQ Printable Documents

Printable 1099 R Form Printable Forms Free Online

96 Best Ideas For Coloring Print Your Own 1099

96 Best Ideas For Coloring Print Your Own 1099

1099r Form 2023 Printable Forms Free Online

Fillable Form 1099 R Printable Forms Free Online

E File 1099 File 1099 Online Pricing Starts As Low As 1 99 form

Free 1099 Tax Forms Printable - As noted earlier in prior years contractor payments were included in Form 1099 MISC If you need to file a 1099 for nonemployee income paid in 2019 you would use the 2019 1099 MISC We cover 1099 MISC and other types of 1099 forms in more detail later in this article The due date for furnishing a copy to your contractors and vendors and filing a copy with the IRS is Jan 31 for most